Imputed Income Pays per Year Override

Maintenance > new world ERP Suite > System > Validation Sets > Validation Set List

To give you the ability to override the number of pays per year in the imputed income calculation for selected pay groups, follow the steps below to create a validation set alternate usage type of Imputed Income and apply it to the appropriate pay groups in the Pay Group validation set.

- Navigate to Maintenance > new world ERP Suite > System > Validation Sets > Validation Set List.

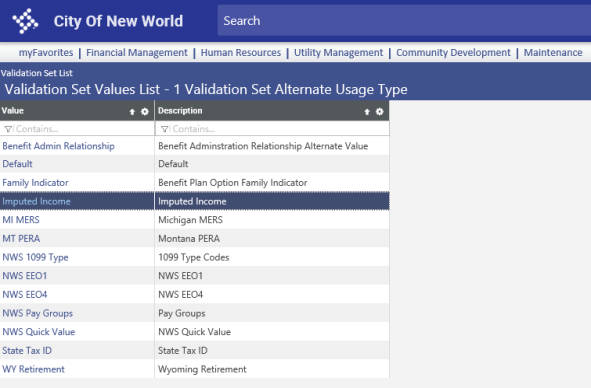

- Select the Set Number 1-Validation Set Alternate Usage Type row.

- Click the Values button.

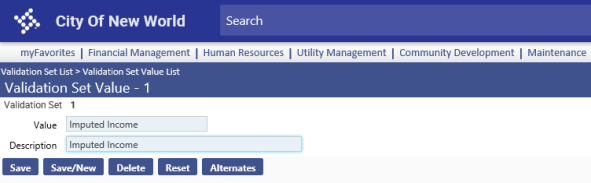

- Click the New button. The Validation Set Value-1 page opens.

- In the Value field, type Imputed Income.

-

In the Description field, type Imputed Income.

View.

View. -

Click Save. Imputed Income is added to the Validation Set Alternate Usage Type grid.

View.

View.

- Navigate to Maintenance > new world ERP Suite > System > Validation Sets > Validation Set List.

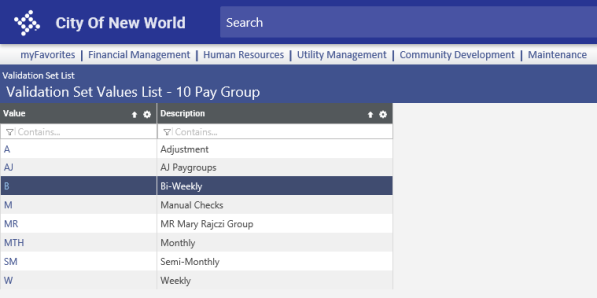

- Select the Set Number 10-Pay Group row.

-

Click the Values button. The Validation Set Values List-10 Pay Group page opens, containing a grid of pay groups.

View.

View. - Select the appropriate pay group.

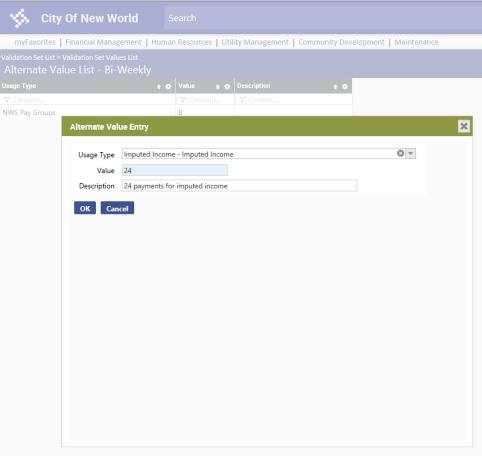

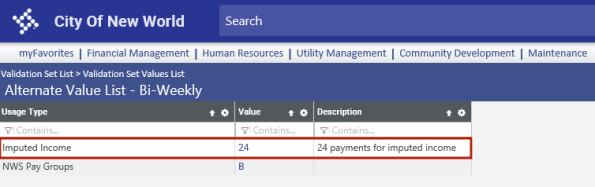

- Click the Alternates button. The Alternate Value List page for that pay group opens.

- Click the New button. The Alternate Value Entry dialog opens.

- For Usage Type, select Imputed Income from the drop-down.

-

In the Value field, type the number of override pays that will be used to divide the annual imputed income. The number of pays specified here will be used for the pay group for any frequency set up at the imputed benefit code that exceeds more than one payment per month, i.e., 24 pays, 26 pays, 48 pays, 52 pays.

Note: Make sure the override number matches the frequency in number of pays on the imputed income benefit code. If the frequency on the benefit code is set for one time per month, the override alternate value is ignored in the calculation.

-

Type a meaningful Description—for example, 24 payments for imputed income.

View.

View. -

Click OK. The Imputed Income alternate value is added to the Alternate Value List grid for the selected pay group.

View.

View.